A new promise by current President Joe Biden has wealthy residents worried about how changes to the tax code will affect their bottom line.

If Biden gets re-elected this year, he vowed to let the Tax Cuts and Jobs Act expire permanently.

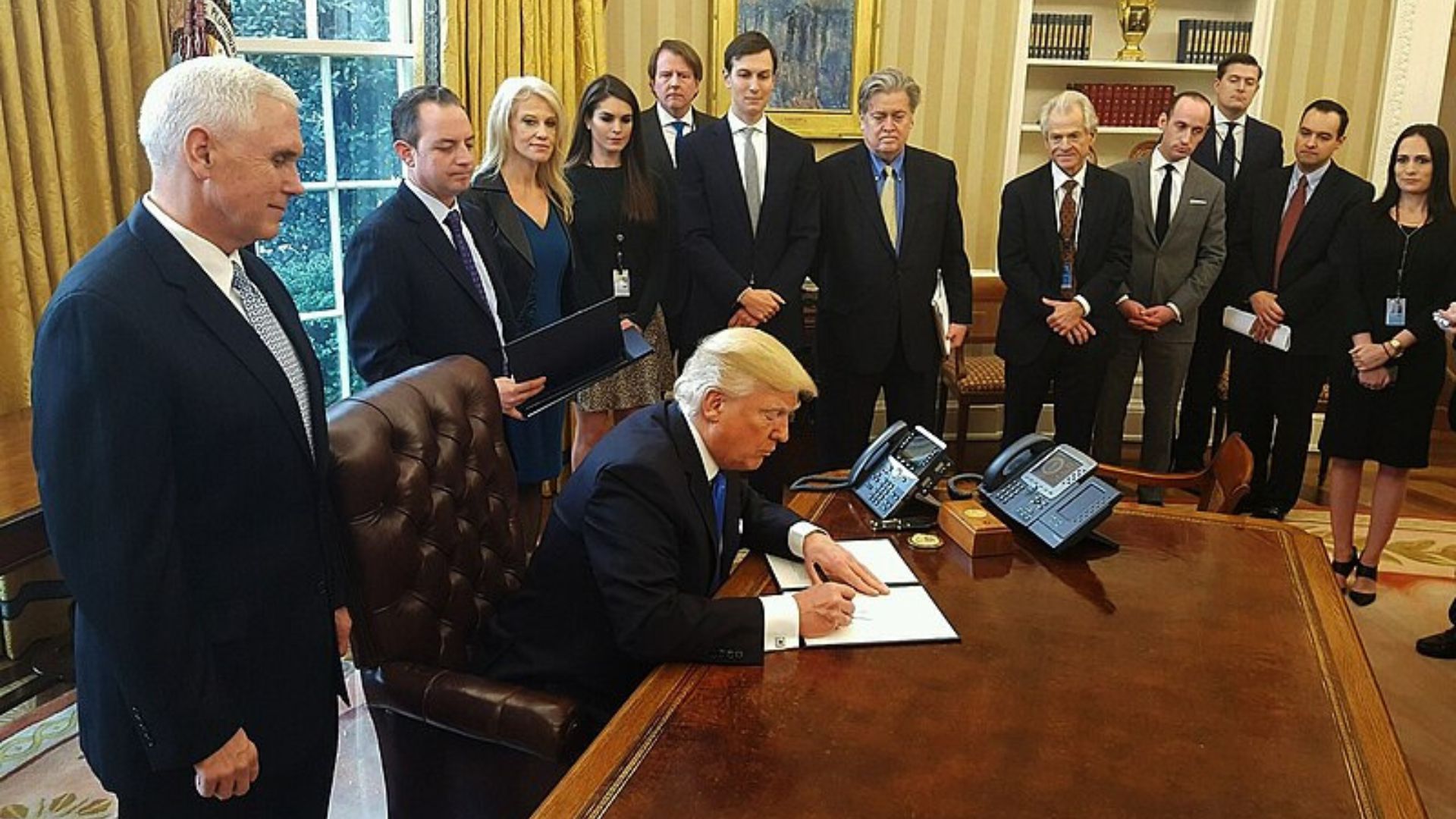

Trump’s Original Tax Ruling

In 2017, former President Donald J. Trump drastically overhauled the tax code. His law completely changed the tax bracket for the wealthiest individuals in the country.

Although it seems small, the tax rate went from 39.6% to 37%. As well, the standard size of a deduction doubled.

What the Tax Ruling Meant for Wealthy Individuals

When Trump allowed the size of deductions for wealthy individuals to double, he effectively allowed them to write off massive items during tax season.

Things like charitable deductions, business write-offs, tax-sheltered investments, and life insurance policies can all be written off during tax season. Taxes are usually something that top earners and healthy individuals use to their advantage.

Biden Tweets in Support of Allowing the Law To Expire

On Tuesday, Biden posted on the social media site now known as X that, “The tax cut is going to expire. If I’m reelected, it’s going to stay expired.”

He also mentioned that the tax cut that Trump was so proud of caused more than $2 trillion in write offs for the wealthiest people in the nation and for the biggest corporations.

Tax Write off Directly Influence Federal Debt

Federal and state taxes all go towards different funds in order to keep society functioning. On a state wide scale, taxes might go to filling potholes or making much needed bridge repairs.

Federally, taxes can go to any number of official funds. Biden also slapped Trump with the argument that the massive tax cuts dig deeply into the federal debt.

Tax Code Is Set to Sunset in 2025

The short term Trump-era GOP tax breaks were added through the Tax Cuts and Jobs Act (TCJA) as one of Trump’s first big orders.

However, the legislation had a time limit and will officially run out on Dec. 31, 2025.

The Law Affects the Countries Top Earners

Trump made his promises good by allowing some of the wealthiest people in the nation to hold onto more of their cash while he was in office.

The tax bracket affected are single filers making more than $578,126. The higher brackets have more to lose. However, even the smallest bracket (%11,001 – $44,725) dropped from 15% to 12% in federal taxes.

Some Experts Disagree with Biden’s Promise

While the Democrats have built a platform on making some of the nation’s wealthiest residents pay their fair share, many experts think that the tax increase will harm real Americans.

Erica York, senior economic and research director at the Tax Foundation, said that “most Americans will see their personal tax bills rise and incentive for working and investing worsen”.

Hot Button Issue for the Next Presidential Election

With gas, food, housing, and childcare costing Americans more money each year, the reversal of a small but meaningful tax cut might spell doom for Democrats.

Many people who will be displeased with the reversal of TCJA may feel like they have no choice but to change their voting behavior.

Trump Back To Pledging Big Tax Cuts

If re-elected this November, Trump has vowed to solidify the TCJA again for Americans.

His pledge no doubt has a strong pull for many Americans fighting to afford everyday life.

A Possibility of Tax Cuts for Low Wage Earners

White House officials have spoken to the press to belabour the idea that Biden has no plans on taking away the tax cut for those earning less than $400,000 per year.

Biden plans on re-administering the tax cuts for lower- and middle-income Americans.

Lawmakers Are Concerned About Worsening National Debt

The Congressional Budget office has estimated that allowing the TCJA to continue may add as much as $3.7 trillion to the federal deficit.

Part of Biden’s platform has been to mitigate any debt risk and allow the federal debt to shrink, not inflate.