In March 2023, thousands of people discovered that their student debt would be paid off in full.

Although only a small subset of data has been identified on the impact of canceling student debt, the individuals who experienced the reset have reported upgrading living situations, getting better jobs, and even starting families.

Real People Benefitting From the Plan

Market Watch published a story about Christina Paliogiannis, a New York public defender who has been struggling to pay her student loans since she graduated law school in 2012.

For years, the lawyer couldn’t afford an apartment in Manhattan and had to settle for hours long commutes to her home on Long Island where she lived rent-free with family.

Huge Relief for Many Falling Behind

Due to her massive monthly payments, Christina had to focus on repaying her loans instead of moving into the city, starting a family, and paying down credit card debt.

Many professionals fall into the same boat. Millions of Americans feel that they are falling behind due to the predatory nature of interest on student loans.

Loan Forgiveness Program Takes Off

Last year, the Public Student Loan Forgiveness (PSLF) program went through massive restructuring in an attempt to help real Americans.

The program was meant to help people working in public service (such as defers and teachers) to have their student loans canceled after a 10 year period.

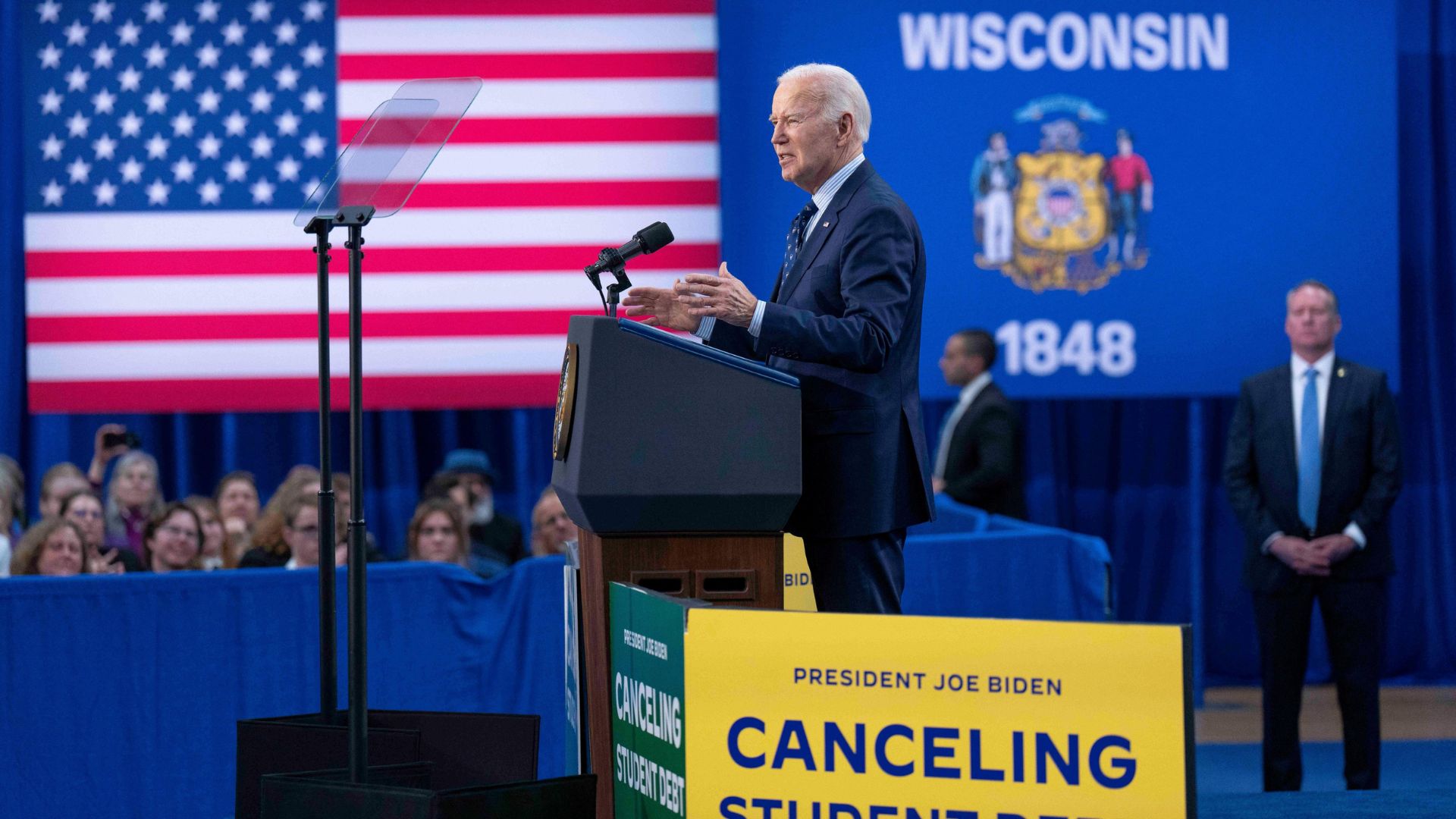

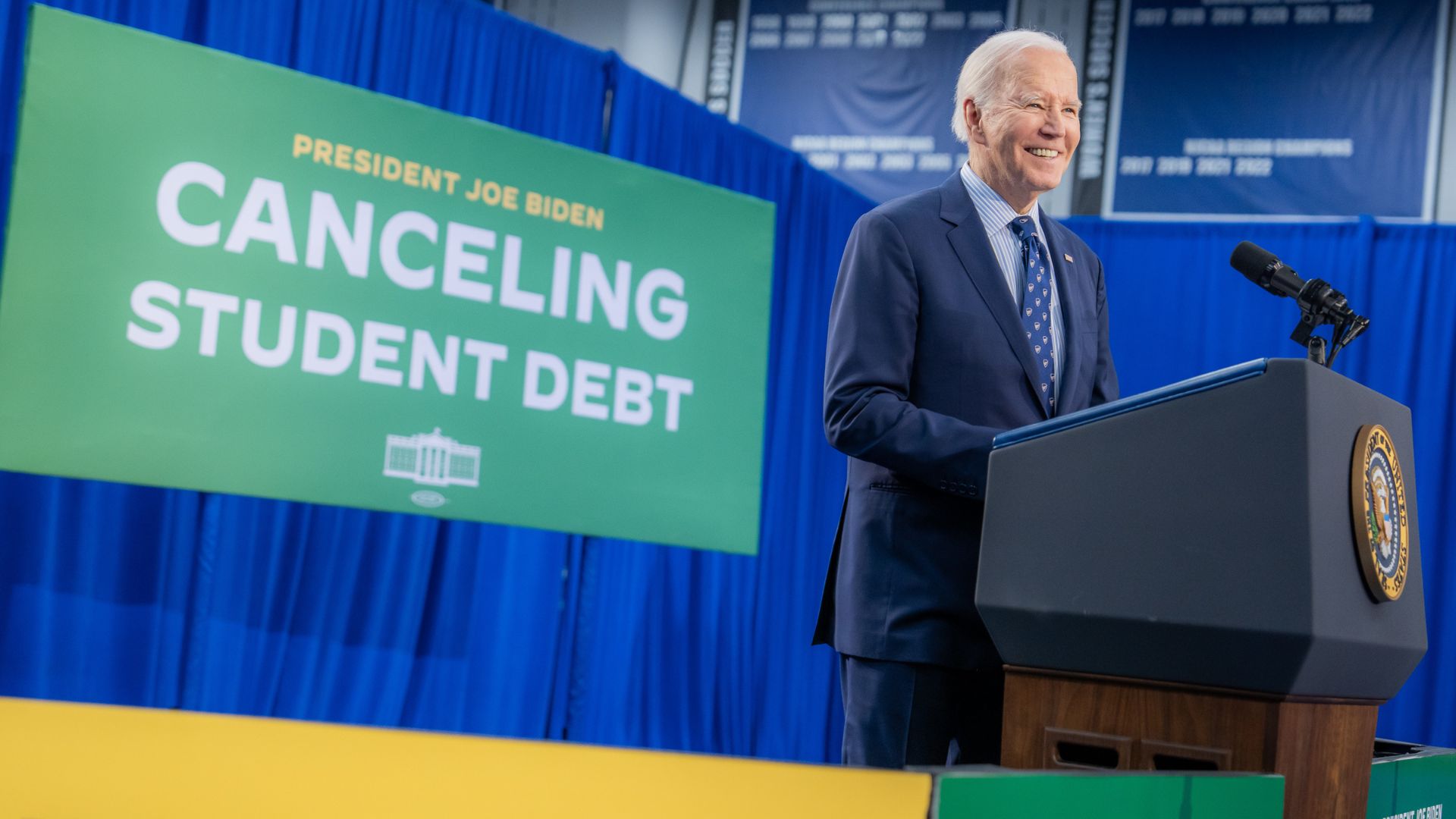

Debt-Free Relief Plan From the Biden Administration

The current presidential administration has canceled more than $158 billion in debt over just a few years.

The debt relief program is focused on assisting families wave as much as $20,000 of student loans or assist with repayment plans.

Four Million Borrowers Enjoying Cancellations

According to the Jain Family Institute, more than 4 million borrowers have had crushing student loan debt canceled.

The group has also published information that shows how young people can go on to start making bigger purchases once their student loans no longer need to be repaid.

Student Debt Holding Borrowers Back From Big Investments

One of the biggest improvements that have come from the debt-relief program is the amount of people who are able to infuse large amounts of cash in big investments, not just interest on loans.

People with canceled loans go on to make big purchases, such as homes and cars.

Other Secured Loans Can Be Used

Some people who have experienced this excellent turn of fate have even gone on to secure small business loans.

The ability for younger generations to contribute to the economy is bountiful once the crushing burden of student loans are removed from the equation.

Ongoing Political Debates About the Topic

For years, politicians have debated the usefulness of wiping out student loans. Some argued that loans need to be repaid no matter the circumstances. As well, many said that not repaying was unfair and could seriously harm the loan industry.

However, the impact of the freed up cash has a greater effect on the overall economy.

Borrowers With a Zero Balance in Much Better Standing

Recent research on the subject showed that those with a zero balance on their student loans between 2020 and 2023 and gone on to accomplish more life goals than those with a positive balance.

Despite high paying professions in the legal and medical field, those with student debt can still experience crushing economic circumstances.

Those Who Have Had Debt Canceled Were Not Previously Well Off

Part of the concern with the program was that the students with the most debt to replay would be in higher paying professions and would make substantially more over the course of their career.

However, thanks to research at the University of Maryland’s School of Public Policy, they discovered that those who have had their debt canceled have, on average, lower salaries than those continuing to repay.

Debt Increased Massively for a Number of Reasons

The student-debt crisis ramped up in recent years due to a number of outside variables.

Some of the reasons for increased loan amounts are due in part to declining state funding, increased tuition, and over-inflated interest charges.

Behavioral Economic Impacts of Debt Cancellation

Debt cancellation has prompted a shift in economic behaviors among millennials and Gen Z. Freed from the burden of student loans, many are now prioritizing savings, investment in retirement funds, and more ethical consumption habits.

These behavioral changes are likely to have long-lasting effects on the economy, encouraging a healthier financial future and fostering a more stable consumer base.

Comparative Global Analysis

Countries like Germany and Australia have implemented their versions of student debt relief with notable outcomes. Germany’s tuition-free higher education system has increased accessibility, while Australia’s income-contingent loan repayment has kept financial stress lower among graduates.

These international models highlight varied approaches to handling student debt and their different economic impacts.

Long-term Economic Projections

Economic forecasts suggest that the debt cancellation could boost consumer spending and enhance workforce participation among young adults.

Over the next decade, this uplift in economic activity is expected to contribute positively to the overall GDP, potentially offsetting some of the initial costs associated with the debt relief program.

Impact on Higher Education Institutions

Following debt cancellation, universities might face pressure to modify tuition rates and financial aid policies.

Anticipated enrollment shifts could lead institutions to rethink their funding structures and educational offerings, ensuring they remain attractive and financially viable in a new economic landscape.

Legal Challenges and Policy Debates

The student debt cancellation has faced legal challenges from opponents arguing it oversteps executive power and disrupts contractual obligations (via CNBC).

Debates continue in political arenas, with stakeholders scrutinizing the policy’s long-term sustainability and fairness across economic classes.

Media Analysis and Public Perception

Media coverage on student debt cancellation varies widely, with some outlets praising the relief efforts and others critiquing the long-term impacts.

Recent polls indicate a split public opinion, where the support varies significantly across different demographic and political groups, reflecting the contentious nature of the policy.

Political Impact on Upcoming Elections

On a related note, debt cancellation is poised to be a pivotal issue in upcoming elections, with the potential to sway young voters who are directly affected.

Politicians are aligning their platforms to either support further educational reforms or propose alternatives that address the systemic issues in higher education financing.

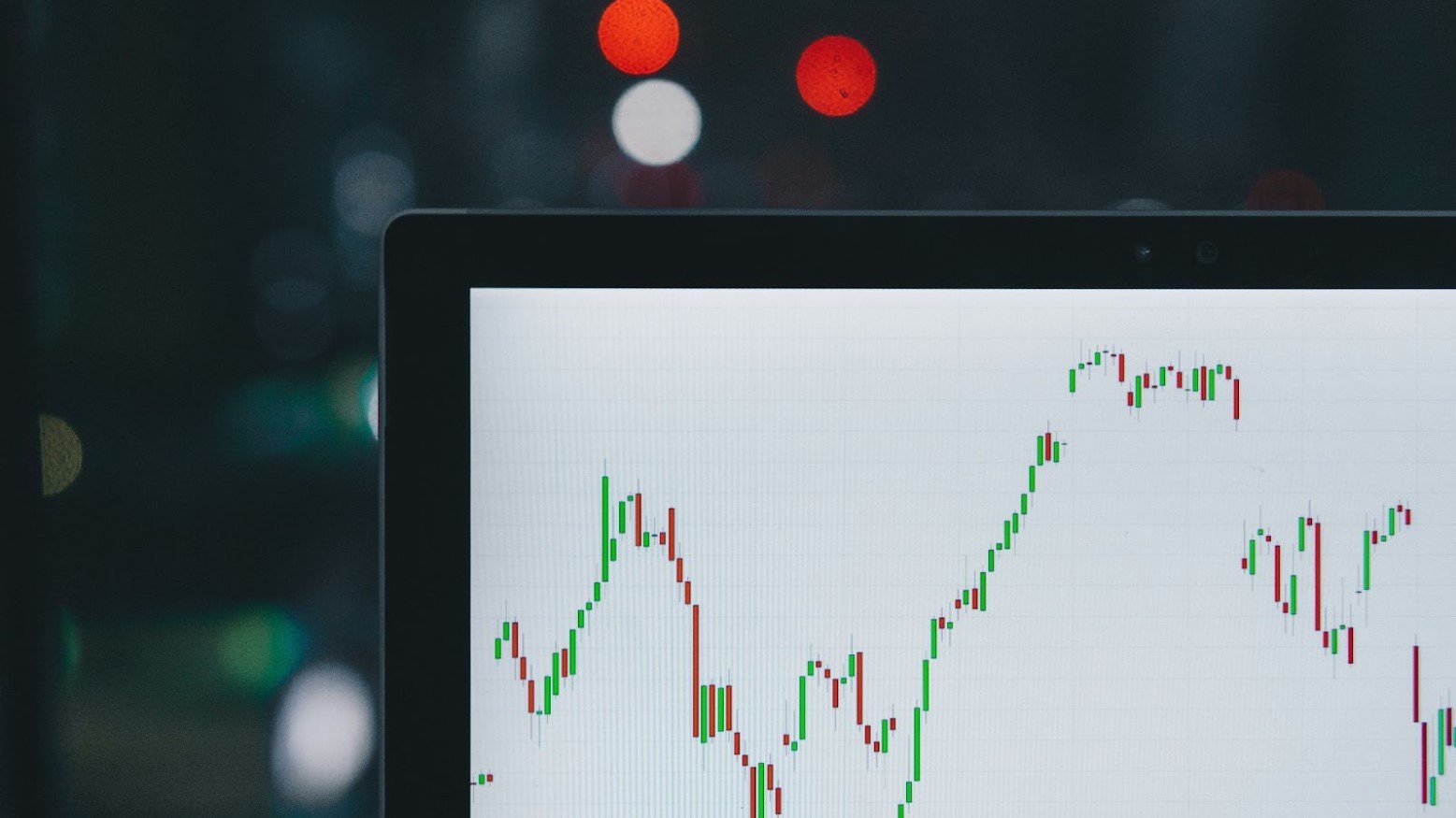

Financial Markets Reaction

The announcement of student debt cancellation was met with mixed reactions in financial markets (via NY Times).

While some investors worry about the potential for increased inflation, others foresee a surge in consumer spending that could benefit sectors like real estate and retail, boosting the economy.

Impact on Credit Scores

For many individuals, the cancellation of student debt has led to immediate improvements in credit scores, enhancing their ability to secure loans for homes and start businesses.

This financial uplift is creating a ripple effect, enabling more robust economic participation and stability.

Expansion to Other Forms of Debt Relief

Inspired by the positive response to student debt forgiveness, there’s growing advocacy for addressing other types of debt, such as medical and credit card debts.

These initiatives aim to replicate the success of student debt relief in alleviating economic pressures on American families.

Economic Impact on Individual States

States like Colorado and New York show significant economic boosts post-debt cancellation, with increased homeownership rates and greater entrepreneurial activity.

These examples show the profound effect of alleviating student debt on local economies and individual livelihoods.

Future Outlook

Student debt cancellation is more than a financial reprieve; —it’s a transformative economic policy with the potential to reshape future generations’ financial landscapes.

As we await its impact, it’s crucial to consider further policy innovations that could continue to relieve economic pressures and enhance American prosperity.