Whenever Americans reach the age of 62, they are eligible to begin receiving federally funded Social Security checks. However, most financial experts agree that the smart move is to wait a few more years to make that money last as long as possible.

But financial guru Dave Ramsey, who famously despises the Social Security system, says Americans should start collecting at 62, but only if they follow these specific rules.

How Does the US Social Security Program Work?

The US Social Security program provides retirement income for almost every employed American. Technically, one can begin receiving these benefits when they turn 62 years old.

However, according to the Social Security Administration, the age of retirement is actually 67. Therefore, if you opt to start receiving your benefits before that time, you get a smaller percentage each month than you would at 67.

Understanding the Math Behind Social Security Checks

While it can be challenging to fully understand the mathematics behind the Social Security program, in the simplest terms, the earlier you start receiving checks, the less money you’ll receive every month.

For example, those Americans who ignite their Social Security benefits at 62 will make 30% less per month than those who begin at 67. It’s organized this way because the SSA assumes that you will live longer and, therefore, will use more of the program’s funding over time.

Waiting Until Your 70th Birthday Means Getting the Most Out of Social Security

Although 67 is the official retirement age, Americans can decide to start receiving their Social Security checks even later.

Several studies show that 70 is the optimal age to start receiving checks, as this is when the highest monthly payout is awarded. Even as people age, the monthly allotment never increases past what it was at age 70.

Most Americans Need Social Security to Replace Their Income

Even though they might make more if they wait to collect their Social Security at 70, the majority of Americans simply can’t wait that long.

The truth is that even financially responsible people with savings need their monthly income to survive. So once they retire, most Americans move straight from paycheck to Social Security checks.

Why Does Dave Ramsey Say 62 Is the Optimal Age for Social Security?

With this information in mind, it may be quite surprising to learn that financial expert and podcast host Dave Ramsey tells his listeners that they should start receiving their Social Security checks at only 62 years old.

However, Ramsey also notes that Americans should only start collecting their Social Security checks at 62 if they do this one specific thing with them.

Reasons to Consider Claiming Social Security Benefits at Age 62

There are a few more reasons why Ramsey recommends that people start claiming Social Security benefits at 62 years old. Ramsey believes that being able to invest this money earlier will allow you to have greater financial flexibility.

Having money available at a younger age provides greater flexibility to make financial decisions.

Ramsey Says All Americans Should Be Investing Their Social Security Checks Into Mutual Funds

The financial expert said on his podcast that people should opt-in to receive their Social Security checks at 62 years old and then immediately start investing them.

Specifically, Ramsey said people should “invest every bit” of their Social Security in “good mutual funds.” While he doesn’t clarify what he considers a “good” fund, the instruction is still quite simple.

Mutual Funds Will Make Seniors More Money Than Waiting to Receive Social Security Checks

Ramsey explained, “That one [mutual fund] will make you more than enough to cover up the difference between your [age] 66 account and your [age] 62 account.”

According to Nasdaq, the current average mutual fund return is about 14.70%, so Ramsey is not wrong in a way. However, his advice has a profound flaw.

Understanding Ramsey’s Perspective

It seems that Ramsey’s advice is based on the belief that Social Security will not be able to live up to its promised benefits after 2035.

The radio host explains that a couple of investment tools will help them take care of themselves in retirement without relying on the government.

When Do Most Americans Start Receiving Social Security?

It’s interesting to note that, according to a survey conducted by Bankrate, most Americans already opt to receive their Social Security checks at 62 years old.

In fact, 27.3% start receiving checks at 62, 13.1% begin at 65, and 24.7% wait until they are 66 years old. And only 10.2 % of Americans hold back until they are 70.

Understanding the Future of Social Security

It’s important to understand that Social Security’s combined trust fund reserves will run out of money in 2035 if Congress fails to make adjustments. The reserves will make up the difference between income and costs after the funds run dry.

After depleting the reserves, the program’s income will still cover about 80% of its promised benefits.

The Importance of Investing

Ramsey emphasizes that investing is the best way to help the younger generation save up for the retirement they want. By investing 15% of their income in growth stock mutual funds through an employee-sponsored 401(k) and a Roth IRA, Ramsey believes that these investments will help create a cushiony future.

But Ramsey explains that it is not enough to simply invest up to one’s employer’s match percentage.

Leveraging Your Retirement Savings

If you have accumulated wealth in your 401(k) and Roth IRA by the time you retire, then you probably don’t need you use all of the money from your Social Security checks.

If this is the case, then Ramsey suggests that you start investing money from the program at an earlier age, and watch it work for you during your retirement.

Diverging Opinions on Claiming Social Security at 62

Not everyone agrees with Ramsey’s recommendations. Financial experts have been warning of the risk that people take by accepting Social Security benefits when they hit 62.

These experts believe that the money can be advantageous if the person has the necessary experience or access to qualified professional advice.

Americans Are Collecting Social Security Early Out of Necessity

However, the decision to start collecting their checks is often based more on retirement and general necessity than on proper financial planning.

This is the underlying flaw in Ramsey’s suggestion: While he says Americans should receive their Social Security checks as early as possible and invest them wisely, the majority of people need those checks at 62 to survive.

Baby Boomers Haven’t Saved as Much as the Younger Generations Assume

Most younger Americans, such as those in the Millenial and Gen Z generations, assume that most Baby Boomers have enough savings to retire comfortably. However, that’s not entirely true.

A survey conducted by the Federal Reserve Board shows that 43% of Boomers have no retirement savings at all, and their median retirement savings is a mere $202,000. That’s nowhere close to what someone would need to retire in today’s economic climate.

The Struggle to Invest

Most people cannot follow Ramsey’s advice. Most people who are considering taking Social Security at 62 are doing so because they need the money to cover their bills. Unfortunately, that means the money can be used to invest in funds.

While most people would like to wait to increase the amount of money they receive from Social Security, it is not always possible.

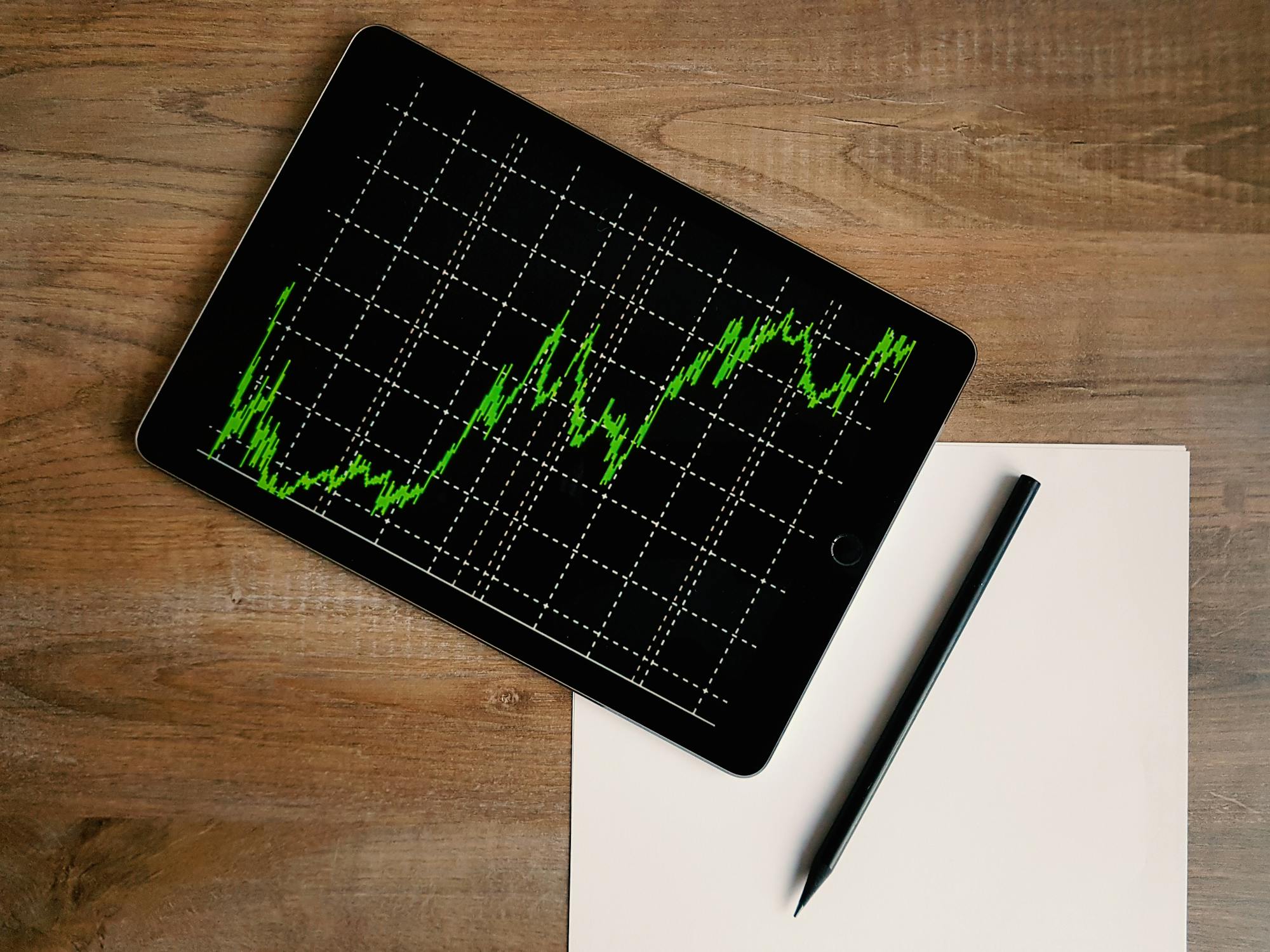

The Risk of Investing in Social Security

Investing your Social Security for profit, however, isn’t guaranteed to be successful. Many things can go awry. You might not end up investing every dollar, despite your best intentions.

Even if you do invest all of it, the returns from the stock market may not reach the levels they have in the past.

The Highs and Lows of Investing

If you start investing your Social Security benefits when the stock market is at its highest point, there is always the risk that the market can subsequently drop and not bounce back. This means that your investment—and social security—is just gone.

If you need to sell your stocks to pay for living expenses during this downturn, then the losses would become permanent because you are selling at a loss instead of waiting for the market to recover.

Don’t Invest Money You Need

A general rule of thumb is that you shouldn’t be investing money that you are going to need to live off of in the next couple of years.

Learn from the faults of Social Security and don’t touch your reserves unless it is absolutely necessary!

A Potential Issue

If you end up taking Social Security at 62 to invest and you end up needing more money at 64 because of a health issue or other pressing financial needs, you will have done yourself a disservice by already shrinking your Social Security benefits.

Choosing early benefits reduces your monthly Social Security payments compared to what they would have been if you waited until your full retirement age or later.

Re-Evaluating the Risk

Social Security is a guaranteed lifetime benefit, even if it does run out of money. Most of the benefits will be there near the end of our lives, helping to make retirement a little easier.

Instead of risking it all by claiming Social Security early, investing, and hoping for the best, it’s often much more sensible for most people to take advantage of the guaranteed income increase that comes with waiting to claim Social Security.

Talk to Your Financial Advisor Before Making Any Decisions Regarding Your Social Security

It’s exceptionally important to understand that while Dave Ramsey is certainly a beloved and widely respected financial expert, he does not know your personal situation.

This advice can be helpful, but it should not dictate your decision. Before deciding when it’s time to start receiving Social Security checks, the best thing to do is speak with a trusted financial advisor about your future. Remember, everyone is different, and what works for some may not be the right choice for you.