Large companies are moving their headquarters out of Austin and home owners and suffering from prices crashing. Altogether, the popularity of the city and the lure for big companies has dwindled quickly.

The recent crash in Austin has people wondering if Austin is the next California?

Big Corporations Have Left the City for Good

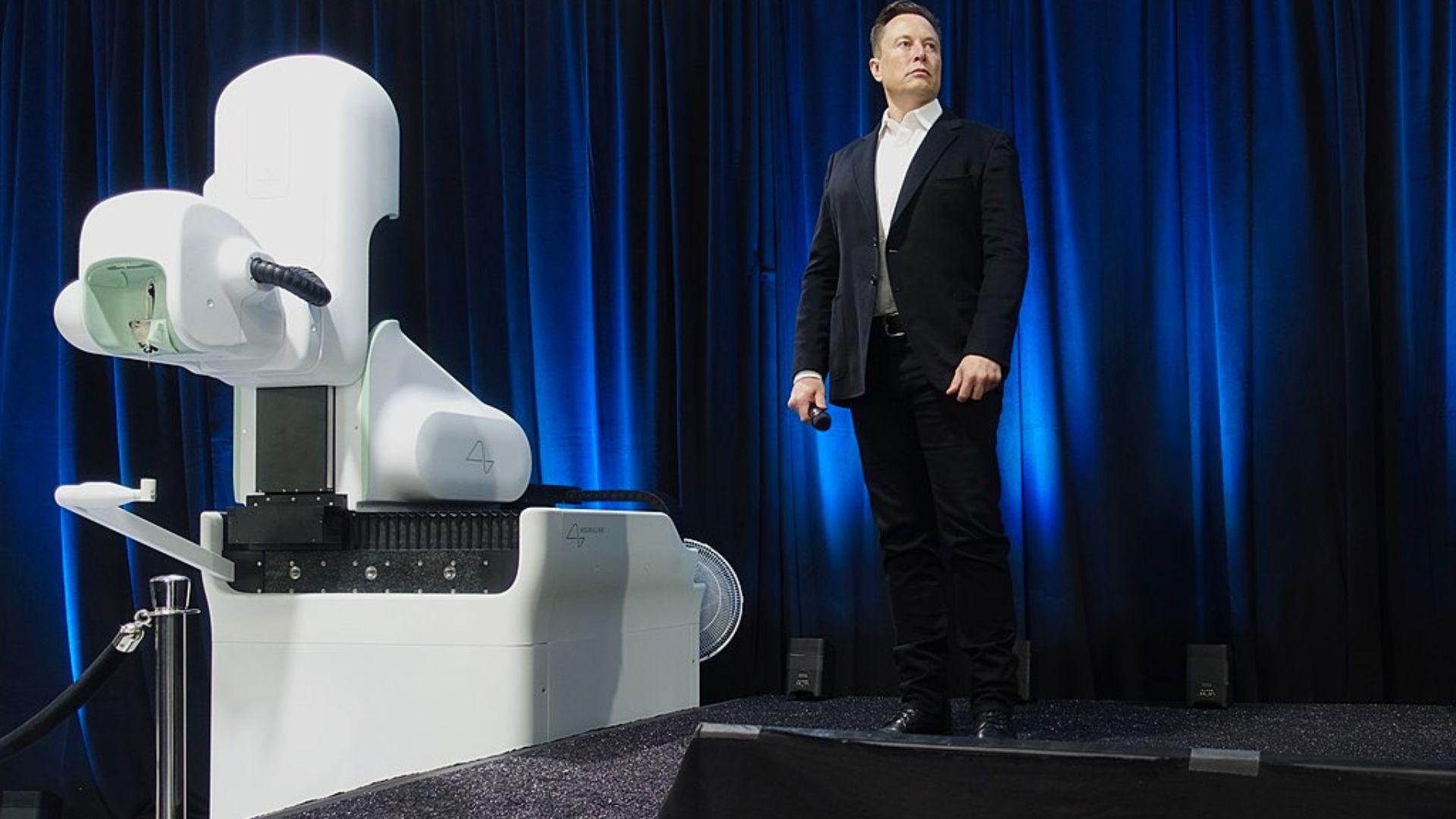

Both Oracle Corp. and Tesla Inc. have moved their headquarters out of the city.

What was once a safe haven for companies who wanted to take advantage of the Texas tax breaks, have now packed up and left for good.

Real Estate Is Failing Rapidly

Currently, a quarter of commercial office space in the city has been left vacant due to companies moving their organizations.

After the pandemic peak of overblown real estate prices, the cost of homes in the Austin area have plummeted further than anywhere else in the country.

Original Lure No Longer Holding Up

In 2020, many companies were fed up with the high corporate tax rates in California and migrated west to Texas to enjoy low taxes and warm weather.

Since then, the city has experienced overblown rent prices and overcrowding with the rash of migration from California residents causing residents to leave in hoards.

Oracle Moving Onto a New Southern City

Oracle Corp. has said that they will be moving their headquarters from Austin in Nashville, Tennessee. Oracle is a company that software company worth about $323.14 billion.

Although the company only arrived in 2020, they clearly didn’t get to experience the Texas oasis that other early adopters experienced.

Massive Drop in Home Prices

The population has been booming in Austin for almost 12 years. It was the fastest growing metro area in the United States, but lost the coveted spot in 2023 when the state began to lose residents for the first time.

Due to the recession in growth, home prices have dropped as much as 18% from the pandemic heights seen in 2022.

Many Homeowners Are Losing Value and Cash

Although home prices have fallen rapidly in just a few years, many homeowners are left with the stark realization that they will be losing massively when they need to sell their home.

The average home price is still some of the most expensive in the country. The fall in house prices means that many homeowners will lose out on much needed equity and resale value.

The Austin-Nashville Feud Heats Up

The two lively cities have been involved in a type of culture battle for a long time. Both have bustling country music scenes, great restaurants, and active downtown cores.

Austinites are feeling left in the dark now that these big tech companies are taking their business to their rival city. Now that the bubble in Austin has popped, many believe that Nashville might be the next hub for tech companies.

Boom in Corporate Relocations During the Pandemic

During the Covid-19 pandemic, many tech companies were finally fed up and left California due to issues with high taxes, overpriced insurance, and homelessness.

In 2022, 64 companies moved their headquarters or a significant portion of their operations to Austin.

Big Tech Cooling Down

Since the initial boom, only 11 companies planted roots in the city so far this year. A massive drop off in growth from previous years.

The massive difference in companies deciding where to land their operations has a big relevance on what is currently happening in the city that they choose. Tech companies like to be a part of up and coming destinations, and leave quickly when the bubble bursts.

Many Companies Reversing Their Decision To Land in TX

In addition to some big companies leaving the state, many have built massive offices but failed to make the final move.

Google Inc. built a massive tower in downtown Austin shaped like a sail on a ship. However, the company has failed to actually move into the multi-million dollar project.

Tesla Laying off Thousands of Workers

Austin based tech company Tesla has announced that they will be laying off roughly 10% of their global workforce.

This month, 2,688 people will lose their jobs as part of a plan to retain some of its revenue in the face of rising real-estate and commercial costs in the city.