Medicare providers are struggling to keep up with the high price tags of coverage and the increase in patient benefit use.

One company, in particular, reports that it will let more than 200,000 patients go this year in order to remain profitable. While some blame the US government, others say corporate greed is certainly a factor.

Understanding the US Medicare Program

In order to fully understand the situation at hand, it’s first crucial to learn exactly how the US Medicare, and more specifically, the Medicare Advantage program works.

Medicare is a health insurance program for Americans aged 65 and older, as well as some under 65 with certain disabilities or chronic conditions.

What Is Medicare Advantage?

Whereas, Medicare Advantage is a specific type of health insurance offered by private companies to include extra benefits that the original Medicare plan doesn’t cover.

According to the AARP, the difference between Medicare and Medicare Advantage is like “choosing between ordering the prix fixe meal (Medicare Advantage) at a restaurant, where the courses are already selected for you, or going to the buffet (original Medicare), where you must decide for yourself what you want.”

The US Government Is Increasing Medicare Advantage Costs

While it can be a little confusing, the general idea is that the US government provides Medicare to millions of aging Americans, while millions of other Americans opt to pay a little extra every month to a private Medicare Advantage plan to receive additional, preplanned benefits.

However, private insurance companies also need to pay the US government at least part of the fees paid by their Medicare Advantage patients. And these fees have substantially increased in recent years.

Companies Are Reducing Benefits to Maintain Profitability

Additionally, the cost of medical care, including surgeries, pharmaceuticals, doctor visits, and really everything else, has also increased. Therefore, private Medicare Advantage companies are losing a significant amount of money by offering a wide variety of benefits.

As Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, explained, “Medicare Advantage is seeing a scaling back from many private insurers, mainly because providers found seniors on it were using more of their Medicare benefits than anticipated.”

Dips in Profits Mean Changes in the Medicare Industry

Beene continued, “This led to a dip in profits for providers like Humana, and now they’re looking to cut ties in any way they can to boost their bottom line.”

And Humana is certainly making some big changes to its offerings and benefits this year. In fact, the company has decided to cut nearly 200,000 patients, as well as limit the benefits available to the remaining clients.

Humana’s Profits Down 29% From Last Year

Humana’s net income was just $679 million in quarter two of 2024, a 29% decrease from the same time last year.

The company’s profit margin sat at 2.3%, down from 3.6% in quarter two of 2023, due to higher expenses. However, the company still made a whopping $29.5 billion in overall revenue, up 10% from last year. In other words, the company is making more, but it’s also spending more.

Humana Is Leaving Several Unprofitable Markets

In response to this reality, Humana has decided to leave several unprofitable markets, which will lead to the loss of around 200,000 patients.

These patients will now have to find another Medicare Advantage provider in their area if they want to continue with the program.

Seniors Working With Humana Need to Get Clarification Now

CEO Jim Rechtin said that while the “vast majority” of Humana patients will still have a plan offered where they live, “If you’re a senior who currently has Medicare Advantage through Humana, now is the time to get clarification on your status for the coming year and make sure no changes are on the way.”

He continued, “If you find you’re going to face the elimination of services through them, you need to start looking at options to replace that coverage immediately.”

Patients Are Not Happy With Their Medicare Advantage Coverage

However, it’s interesting to note that many Americans are widely disappointed with Medicare Advantage.

Some experts believe that those hundreds of thousands of people losing coverage with Humana may choose to use the governmental-provided Medicare instead. Though there are certainly downsides to that option as well.

Medical Care Is Becoming Increasingly Expensive

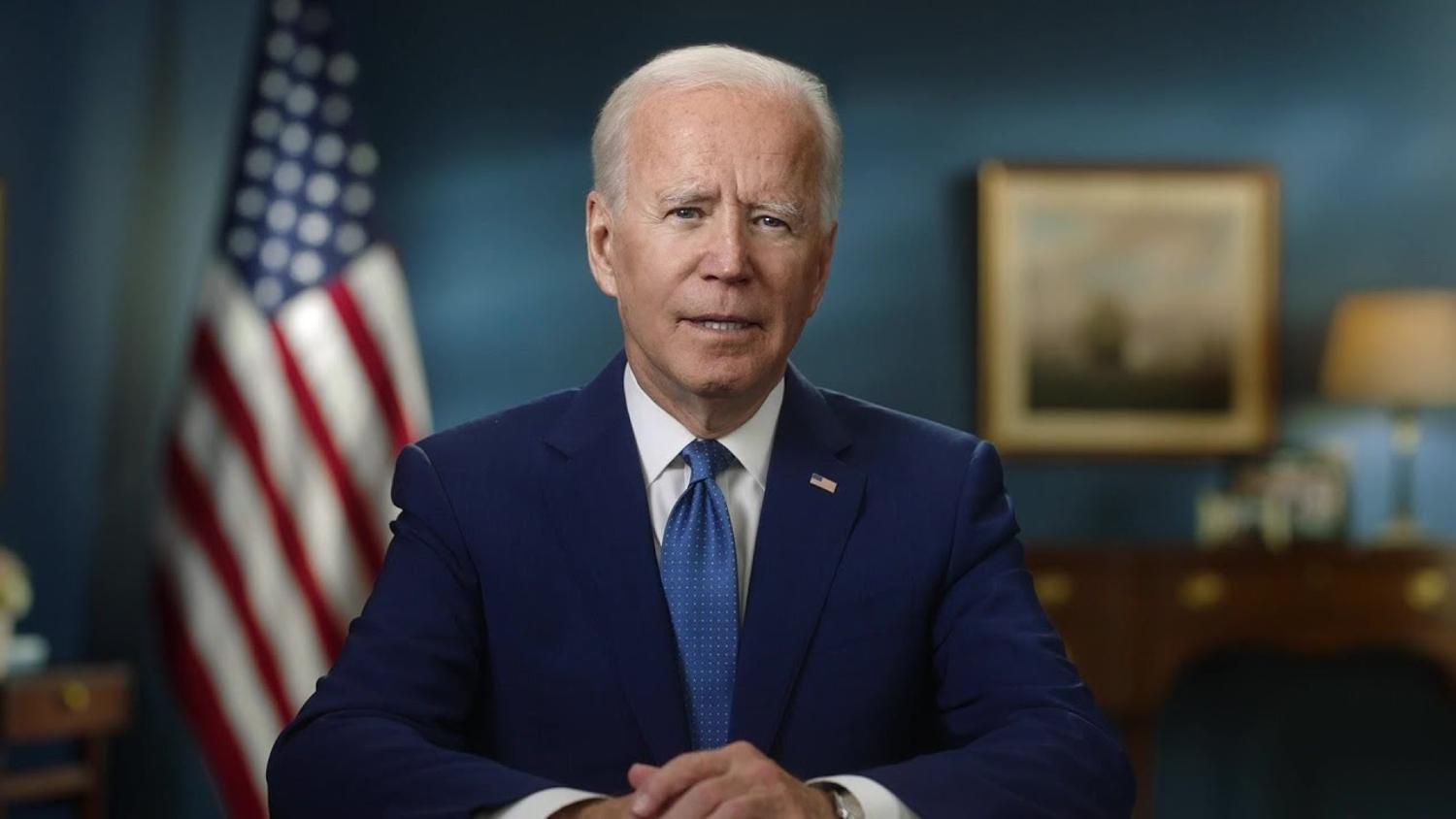

President Joe Biden is undoubtedly one of the most controversial presidents in the nation’s history. His many policies, including the Inflation Reduction Act, sparked widespread debate among Democrats and Republicans alike.

However, no matter how one feels about the president, it’s important to understand the Inflation Reduction Act will “[put] more financial risk onto the health insurance companies and pharmacy benefit managers that offer drug plans and put a limit on out-of-pocket spending for beneficiaries.” Essentially, the act will increase costs for insurance companies and medical professionals, which will unquestionably affect millions of Americans.

Elderly Americans Could Find Themselves in Trouble Next Year

With all these changes to the nation’s Medicare and Medicare Advantage plans elderly Americans could find themselves in trouble over the coming year. Other companies, like Humana, may make significant changes to their programs to keep profits growing rather than shrinking or even remaining stagnant.

Again, while some will blame President Biden and the government, others say these companies should be willing to make a little less to ensure millions of Americans get the care they desperately need. However, unfortunately, that’s not how capitalism works.

Doctors’ Choices

Doctors have the discretion to choose which health insurance plans they accept, and many do not opt to participate in government-run programs like Medicaid and Medicare.

These programs primarily serve low-income individuals and seniors.

Declining Participation in Medicare and Medicaid

Over time, more doctors have stopped accepting Medicare and Medicaid due to significant payment reductions.

Since 2001, these payments have decreased by an alarming 26 percent, according to the American Medical Association.

Upcoming CMS Cuts to Medicare and Medicaid Payments

Next year, the Centers for Medicare and Medicaid Services (CMS) plans to implement further cuts.

These include a 2.8 percent reduction in the conversion factor for the fee schedule.

Ongoing Trend

As reimbursement rates continue to decline, many doctors have made the difficult decision to stop serving Medicare and Medicaid patients.

This trend has been building for years.

Survey Findings

A 2023 Medscape survey revealed that only 65 percent of doctors were willing to accept new Medicare and Medicaid patients.

Additionally, 8 percent indicated they would no longer accept them.

Plans to Limit Medicaid Patients

In a recent survey this year, 14 percent of doctors reported plans to reduce their Medicaid patient load.

Additionally, 66 percent identified reimbursement rates as their biggest challenge with Medicaid.

Expert Insight on the Deteriorating Trend

“This has been an unfortunate trend for a few years now and is only getting worse,” said Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, in an interview with Newsweek.

“The reality for most doctors is that an increasing portion of their revenue depends on reimbursements from insurance, Medicaid, and Medicare.”

Impact of Reimbursement

Beene continued, “The more challenging it becomes to get reimbursed, the more likely doctors are to stop accepting these patients”

“The sad part is that this situation is detrimental to doctors, their staff, and their patients.”

Financial Implications and Challenges

Many doctors who have dropped Medicare and Medicaid patients report lower patient volumes but higher overall revenue.

“It is increasingly common for doctors to stop accepting Medicare and Medicaid,” Chris Fong, a Medicare specialist and CEO of Smile Insurance, told Newsweek. “The doctors I’ve spoken with feel that the additional paperwork and bureaucratic hurdles hinder their ability to focus on patient care.”

Consequences for Patients

For patients, losing access to potential physicians can have significant consequences.

“This is extremely disruptive to patient care,” Fong explained. “We often see cases where patients in the midst of treatment are forced to find a new doctor because theirs no longer accepts Medicare, leading to a disruption in care. Unfortunately, people on Medicare or Medicaid usually have no other option but to change their doctor or pay out-of-pocket.”

Lower-Quality Providers

As fewer doctors accept these insurance plans, patients may be forced to seek care from lower-quality providers or travel long distances to find a doctor who does.

This situation can potentially lead to delayed care and missed diagnoses.