The US housing market has seen its fair share of highs and lows, but many say the current situation is cause for concern.

However, experts say they have the answer to fix the entire housing crisis. It’s not actually a new idea; however, it has never been utilized before. It would take some time to implement, but housing gurus believe both political parties and every American would benefit in the long run.

The US Housing Crisis

Understanding the United States housing market is challenging for even the most adept financial expert. While some people say the current market is in crisis, others argue that it’s simply at a low point.

But either way, the housing market is undoubtedly in trouble. High mortgage rates, high house prices, and even a housing shortage are plaguing Americans, and most people agree something needs to change.

Why Is America Experiencing a Housing Shortage?

One of the biggest problems within the US housing market is the housing shortage; according to Zillow, there are currently 4.5 million fewer homes than needed to house the US population.

What’s interesting about this situation is that the US is not suffering from a land shortage. In fact, the country has an abundance of unused or underutilized land at its disposal to build the homes Americans so desperately need.

Why Aren’t Companies Building Homes on This Land?

Here’s where things get a little complicated: Companies aren’t using the excess land to build homes for Americans because they will actually make less money if they do.

And that is because the US uses a property taxation system that increases the tax percentage when large homes, apartment buildings, or other developments are built. Therefore, it behooves landowners to use their land for less expensive projects.

The Solution to the Housing Shortage in America

Many say the solution to this issue would be to change the taxation process to tax landowners on the plot of land itself, not on what they chose to build there.

This system is called land-value taxation, and while it’s not a new idea, it has gained significant traction in recent years as Americans are desperate for housing to become both accessible and affordable again.

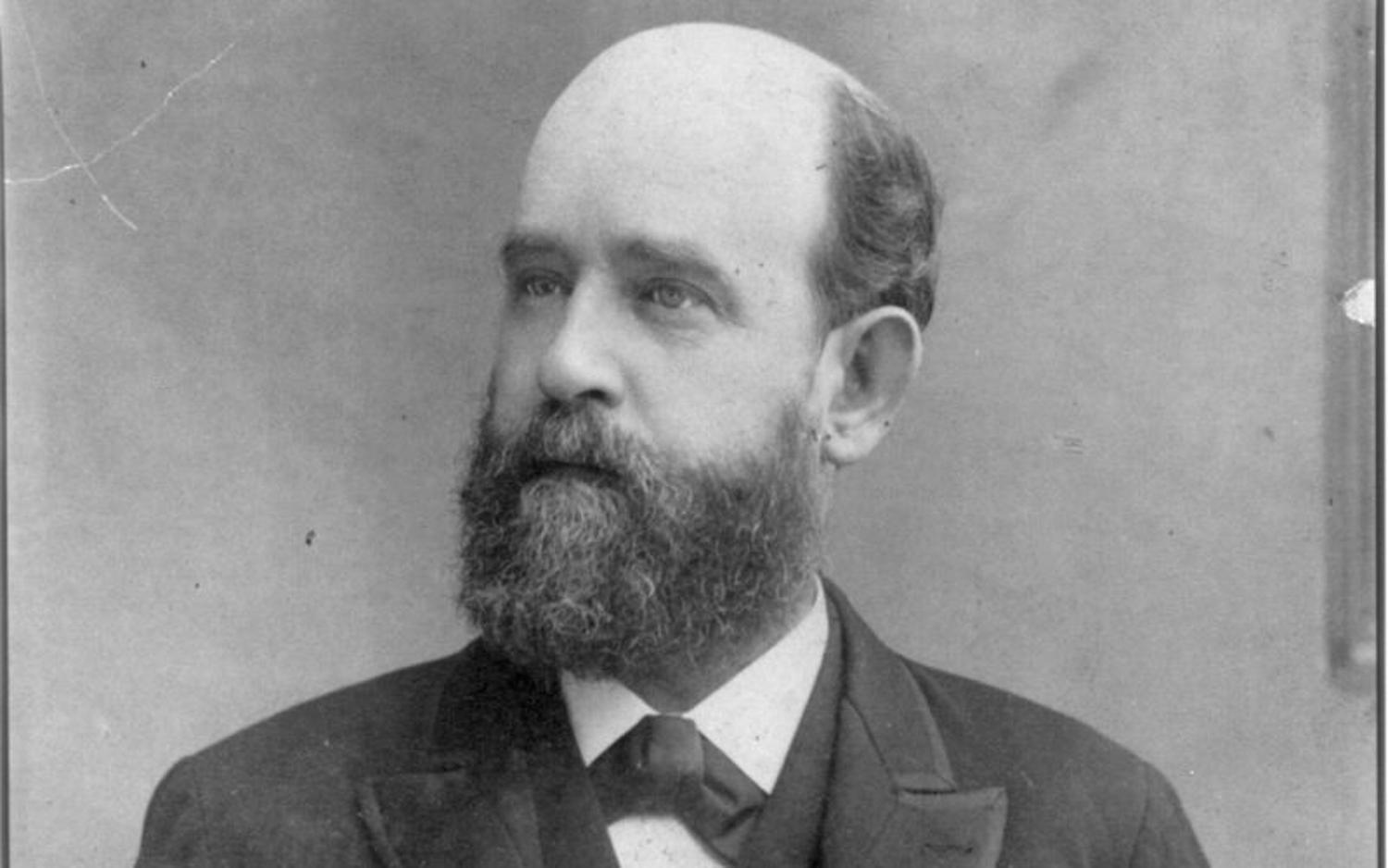

Henry George’s Land-Value Taxation

The idea of land-value taxation was first presented by the American political economist Henry George in 1879. At that time, George wrote a bestselling book entitled “Progress and Poverty” in which he laid out his grand plan.

George said that industrial capitalism was oppressive to the working class and that one way to fix the broken system was to share natural resources with everyone instead of placing them in the hands of the nation’s elite. That’s where land-value taxation came in.

How Land-Value Taxation Can Help the Masses

By taxing landowners annually based on the value of their land, George and the followers of what is now called Georgism argue that the government could encourage investment and the most efficient use of the land.

It would incentivize landowners to maximize revenue by building homes, apartment buildings, and other developments instead of parking lots, which would certainly benefit the American people.

Modern Day Experts Believe Land-Value Taxation Would Benefit Both Political Parties

Today, it’s nearly impossible to find a topic that both conservatives and liberals agree with. However, housing experts argue that land-value taxation could be attractive to both political parties.

Those who lean left will appreciate that this is a more progressive tax, while conservatives and libertarians enjoy the plan’s efficiency and pro-development undertones.

Encouraging Development Will Help the American Economy

In addition, land-value taxation could also improve the US economy. Taxes, as they exist today, penalize capital and labor usage and diminish the amount of construction and employees landowners utilize. However, the land-value tax would encourage building and employment across the country.

As Gregor Schwerhoff, an economist in the Structural and Climate Policies Division at the International Monetary Fund, explained, “The main point is that the supply of land will not be reduced by the tax, and so you’re not discouraging economic activities.”

Land-Value Taxes Are Especially Helpful in Cities

While many argue land-value taxes should be implemented around the country, they would certainly be the most helpful in major metropolises that are starting to run out of viable land.

Although it may seem as though America’s cities are filled to the brim with housing and office spaces, there is still a great deal of underutilized land because of the current taxation system. Experts argue that by changing this one simple regulation, hundreds of thousands, if not millions, of homes would soon become available.

A Few US Cities Have Already Implemented Land-Value Taxation

Some US cities have already begun experimenting with Henry George’s land-value tax plan. More than a dozen cities in Pennsylvania, including the capital cities of Harrisburg and Pittsburgh, say the new system has been extremely successful.

Additionally, Minnesota and Detroit, Michigan, lawmakers have proposed the transition to land-value taxation to their residents. Whether or not they will vote in favor remains to be seen.

It Will Take Time Before an Entirely New Tax System Can Be Integrated

Even if the American people do get on board, it will take time before the city, state, or even the federal government can completely transition the nation to a land-value taxation system.

There will unquestionably be bumps along the road, such as valuing the land and how it will affect other taxes, including property, sales, and income tax. However, many genuinely believe that this 150-year-old idea could change and improve the US housing market forever.